Prevent Stress This Tax Obligation Season with an Effective Australian Online Tax Return Option

Prevent Stress This Tax Obligation Season with an Effective Australian Online Tax Return Option

Blog Article

Why You Should Take Into Consideration an Online Income Tax Return Refine for Your Financial Needs

In today's hectic environment, the on the internet tax obligation return process presents an engaging remedy for managing your financial obligations effectively. The real benefit may lie in the accessibility to specialized resources and assistance that can significantly impact your tax obligation end result.

Convenience of Online Filing

The convenience of online declaring has transformed the way taxpayers approach their tax obligation returns. In a period where time is beneficial, on the internet tax obligation filing systems provide taxpayers with the adaptability to finish their returns from the comfort of their workplaces or homes. This ease of access gets rid of the demand for physical journeys to tax preparers or the article workplace, dramatically lowering the headache commonly associated with typical filing approaches.

In addition, on the internet filing solutions use user-friendly interfaces and step-by-step advice, permitting people to navigate the procedure easily. Numerous systems incorporate functions such as automated computations, error-checking, and immediate accessibility to prior year returns, boosting the total filing experience. This technological innovation not just streamlines the prep work process however likewise encourages taxpayers to take control of their economic responsibilities.

Moreover, online declaring enables the smooth integration of various tax records, consisting of W-2s and 1099s, which can frequently be imported directly into the system. This streamlining of details decreases information entrance mistakes and boosts accuracy, ensuring a more reliable entry (Australian Online Tax Return). Eventually, the ease of on-line filing represents a significant change in tax prep work, lining up with the developing needs of modern-day taxpayers

Time Effectiveness and Speed

Timely conclusion of income tax return is a critical aspect for many taxpayers, and on the internet filing significantly improves this aspect of the process. The electronic landscape simplifies the whole income tax return process, lowering the time needed to collect, input, and submit required details. On the internet tax obligation software commonly consists of features such as pre-filled forms, automated estimations, and easy-to-navigate interfaces, enabling customers to finish their returns much more successfully.

In addition, the ability to gain access to tax obligation records and information from anywhere with a net link removes the demand for physical paperwork and in-person visits. This adaptability makes it possible for taxpayers to function on their returns at their benefit, consequently decreasing the stress and time pressure commonly linked with standard declaring approaches.

Cost-Effectiveness of Digital Solutions

While several taxpayers might initially perceive on-line tax filing options as an included cost, a closer exam discloses their integral cost-effectiveness. Digital platforms typically come with reduced charges compared to conventional tax prep work services. Several on-line service providers provide tiered pricing structures that allow taxpayers to pay just for the services they really need, lessening unneeded costs.

In addition, the automation intrinsic in on-line solutions streamlines the declaring procedure, lowering the chance of human mistake and the capacity for costly alterations or fines. This effectiveness converts to considerable time cost savings, which can equate to economic savings when considering the per hour rates of expert tax preparers.

Boosted Precision and Protection

Along with improved accuracy, on the internet tax obligation declaring additionally focuses on the security of sensitive personal and financial information. Trusted online tax obligation solutions use durable file encryption innovations to secure data transmission and storage space, significantly reducing the risk of identification burglary and scams. Routine safety and security updates and conformity with sector requirements better strengthen these defenses, supplying assurance for customers.

In addition, the capability to gain access to tax records next and info safely from anywhere permits for better control over individual economic data. Users can conveniently track their filing status and retrieve vital papers without the threat related to physical duplicates. In general, the mix of increased accuracy and security makes on-line tax submitting a wise option for individuals looking for to improve their tax preparation procedure.

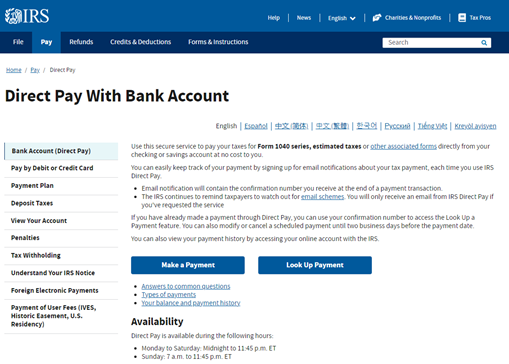

Access to Specialist Support

Accessing experienced support is a significant benefit of online tax obligation filing systems, offering customers with assistance from educated experts throughout the tax obligation preparation procedure. Most of these platforms supply access to qualified tax experts that can assist with complicated tax obligation issues, making certain that users make notified choices while taking full advantage of credit histories and reductions.

This professional support is commonly readily available with numerous networks, including online conversation, video clip calls, and phone assessments. Such access allows taxpayers to seek information on click reference certain tax obligation regulations and laws or receive tailored guidance tailored to their distinct monetary scenarios (Australian Online Tax Return). Having a professional on hand can reduce the anxiety connected with tax filing, especially for individuals dealing with complicated financial scenarios or those unfamiliar with the most current tax obligation codes.

Additionally, on the internet tax systems regularly supply a wide range of sources, such as training videos, posts, and FAQs, improving users' understanding of their tax commitments. This comprehensive support group not only promotes self-confidence throughout the filing procedure however likewise gears up customers with important knowledge for future tax obligation years. Inevitably, leveraging experienced support through online tax return processes can lead to more precise filings and maximized financial results.

Final Thought

Finally, the on the internet tax obligation return process provides significant advantages for people looking for to manage their economic demands effectively. The benefit of declaring from home, integrated with time efficiency, cost-effectiveness, enhanced precision, and durable protection, underscores its appeal. In addition, access to experienced assistance and resources equips users to maximize deductions and improve their tax obligation experience. Accepting digital options for tax obligation preparation eventually stands for a forward-thinking approach to economic monitoring in an increasingly electronic world.

Prompt conclusion of tax returns is a vital factor for several taxpayers, and on-line filing dramatically improves this aspect of the procedure. By directing individuals via the declaring procedure with intuitive motivates and mistake notifies, on the internet solutions aid to eliminate typical errors, leading to an extra precise tax return.

Overall, the combination of increased accuracy and protection makes on the internet tax obligation filing a smart option for individuals seeking to streamline their tax obligation preparation procedure.

Having an expert on hand can relieve the anxiety linked with tax declaring, specifically for people facing complicated financial scenarios or those strange with the newest tax codes.

Additionally, on the internet tax platforms frequently provide a riches of sources, such as instructional video clips, short articles, and Frequently asked questions, enhancing customers' understanding of their tax obligations.

Report this page